|

| FINANCIAL EDUCATION |

MEANING OF FINANCIAL KNOWLEDGE

What do you understand by Financial Literacy or Financial Knowledge?. Financial knowledge is the ability to understand and apply various financial skills, including managing personal finances, budgeting, and investing. Financial literacy is the foundation of your relationship with money, and it is a lifelong learning journey.

We go to schools, colleges, universities to complete our educated and start earning our livelihood. We take up jobs, practise professions or start our own businesses so that we can earn money to make our living. But which of these institutions make us capable of managing our own hard-earned money? .Our ability to the effectively manage our money by drawing systematic budgets, paying off our debts, making buying and selling decisions and ultimately becoming financially self-sustainable is non as financial literacy.

BASIC FINANCIAL KNOWLEDGE. Financial knowledge basics explain bank accounts, Online and Mobile Banking, Credit Cards, Credit Cards, Cheque, PAN Card, ATM awareness, Loans, Investment and Insurance, Taxes, Interest, Budgeting, Debt Management, Identifying theft protection, Savings, and Financial Goals. Financial knowledge means a lot of skills that you can apply when choosing what to do with your money.

FINANCIAL SKILLS .There are five basic skills in financial knowledge/literacy: They are

- Acquisition,

- Storage&Investment

- Spending

- Borrowing,

- Security

Financial knowledge can be increased by the following

1). Actually, Stick to a Budget. 2). Stop Spending Your Whole Paycheque. 3). Get Real About Your Financial Goals. 4). Educate Yourself About Your Student Loans. ..5). Figure Out Your Debt Situation. 6). Establish a Strong Emergency Fund.7). Don't Forget Retirement

FINANCIAL KNOWLEDGE STUDY FROM BEGINNING STAGE Financial Learning about children of all ages amidst the small decisions of making financial decisions in the real world. Schools teach students how to use cash. However, they are no longer learning how to save money and use it to achieve their dreams. As college students discover ways to save money, pensions, taxes, and Social Security. They will know better what to do with their money

|

| study from the beginning stag |

KNOWLEDGE OF INVESTMENT Financial knowledge is essential to the normal aspects of life in today's society. These are loans, credit cards, investments, and health insurance. Financial literacy consists of a few financial appendages and skills that allow people to manage money and debt. The purpose of teaching financial information is to help people develop a solid knowledge of the basic concepts of money and how to manage their money.

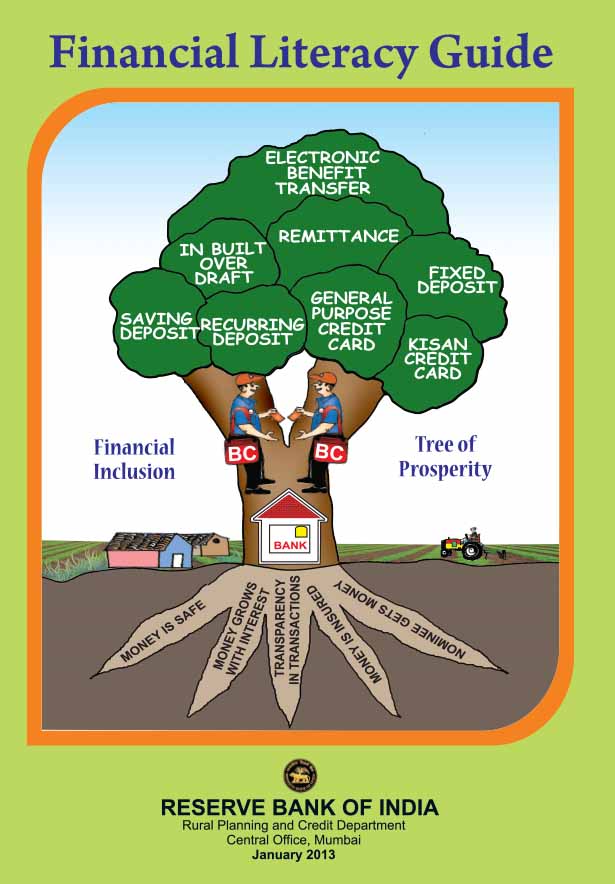

RESERVE BANK OF INDIA AND FINANCIAL LITERACY.

Reserve bank of India has initiated the following steps to promote financial knowledge/literacy.

a)Pedagogy of Financial Education. b)Capacity building in educational institutions as well among NGOs:c)Training programs for trainers.d) Banks and financial institutions play a role in this promoting financial literacy.e)Bank and financial acceptance of school institutions.f)Visual classes

AWARNESS PROGRAMME

Films, theaters, street show - Participating in shows - financial education for Financial Education Camps in remote areas -outreach visits. Essay / Quiz Competitions.Visits by schoolchildren to RBI - Financial Counseling and Literacy Centers - Talks on Radio / Television, etc.

FINANCIAL KNOWLEDGE OF LOSS, RISK, PROFIT. Financial knowledge is the integration of finances, credit points. How much debt management knowledge is important in order to make the right choices and choices that are important in our daily lives. The purpose of financial information is to create a sense of management over your price range, to use cash as a tool of choice, and to build a proud lifestyle. Effective cash management involves spending money to achieve private dreams and personal goals that may range from normal spending to long-term economy. When we purchased goods for reselling and sold them less than the original price/purchase price, it is called loss, and sold it more than the original price/purchase price it is called profit. A person who takes a business without looking for loss or profit, maybe profit is presumed that is a risk. Risk is bearing uncertainty.

|

| FINANCIAL KNOWLEDGE |

FINANCIAL STUDY IN INDIA.Literacy is a basic and critical skill that everyone should have. But in India, talking about finances at home is not uncommon, and many do not have the basics to manage money, whether it be savings, investing, buying insurance, or emergency. The importance of savings and investment is an important factor that should be addressed from the outset. This will help one to understand the law of golden investment- starting early. Financial literacy is one factor that determines the economic growth of a developing nation like India.

According to a global survey conducted by Standard &

Poor’s Financial Services LLC (S&P), India is home to 17.5 percent of the

world’s population, but about 76 percent of its adults do not even understand

basic financial concepts. Not only will it help you to build long-term wealth

but it will also protect you and your family in the event of an emergency.

In conclusion of the article, Financial knowledge can enable an individual to make up a popular companion to distinguish what he buys, what he spends, and what he owes. This subject also influences entrepreneurs, who incredibly add to fiscal development and the strength of our frugality. Fiscal knowledge helps people in getting independent cash transaction capacity. It empowers you with introductory knowledge of investment options, fiscal requests, capital budgeting, etc.

===============================================================

.