SOURCE OF BUSINESS FINANCE

Introduction: It

provides an overview of the blog different sources of money can also be bought

to start running a business. It also discusses the advantages of various sources and

factors that determine one's a suitable source of trade finance. This is

important for anyone who wants to start a business to know about different

sources where money can be raised. It this also important to know relative

properties and sources so that choice of a suitable source can be made

MEANING AND IMPORTANCE OF SOURCE OF BUSINESS

FINANCE: Essential finance for

businesses to set up and run their operations is known as business finance. No business

can function without sufficient funds to undertake various undertakings activities.

Money is required for the purchase of fixed assets (fixed capital) requirements,

to run day-to-day operations (working capital requirement), and to undertake growth and expansion plans in a

business organization.

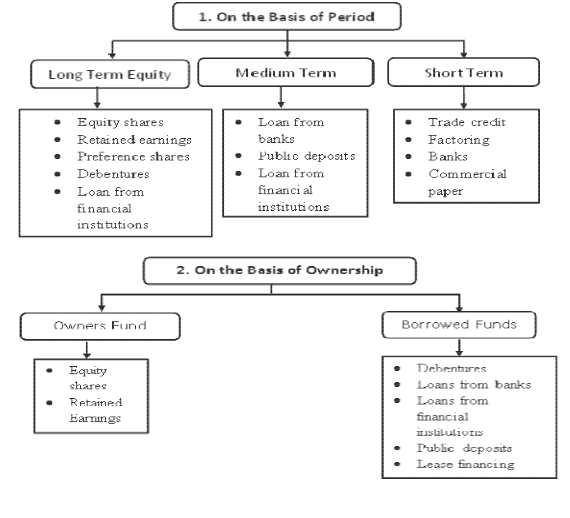

CLASSIFICATION OF SOURCES OF FUNDS: Various sources of funds available for a business

can be classified according to three major bases, which are:

(i)

Time period

(long, medium, and short term),

(ii)

Ownership (owner's fund.)and borrowed funds,

and

(iii)

The source of

production (internal sources and external sources).

LONG, MEDIUM AND

SHORT-TERM SOURCES OF FINANCE: Sources that provide funds

for a period of more than 5 years are called long-term sources. A source that meets

the financial requirements for a period exceeding one year but not more than 5 years

are called medium-term sources and those sources which the provision of funds for

a period of more than one year is called short terms source.

OWNER'S FUNDS AND BORROWED FUNDS: Owner's funds refer to the fund which is provided

by the owners of an enterprise. Borrowed capital, on the other hand, refers to

money that is generated by way of loan or borrowing from another person or institution.

INTERNAL AND EXTERNAL SOURCES: The internal sources of capital are generated within

the business, such as through the retained profits. On the other hand,

external sources of capital are those which are arranged from outside such as

finance provided by suppliers, lenders, and investors.

SOURCES OF BUSINESS FINANCE: Sources of money available for business includes

retained earnings, business credit, factoring, lease financing, public deposits,

commercial paper, and the issue of shares and debentures commercial banks,

financial institutions, and international sources of finance.

RETAINED

INCOME: This is part of the

company's net income. Earnings not distributed as dividends are known as retained

earnings. An amount of available retained earnings depend on the company's

dividend policy. This is usually used for the growth and expansion of the company.

Trade Credit: Credit given by one trader to another for purchasing goods

or services are known as trade credit.

Trade credits provide a business loan purchase facility supplied on

credit. Business loan terms vary by industry to industry.

FACTORING: Factoring has emerged as a popular source of

short-term funds in India in recent years. It is a financial service whereby the

factor is responsible for all providing credit control and debt recovery from the

buyer and protection against any bad credit loss to the firm. There are two methods

of factoring- recourse and non-recourse factoring.

LEASE

FINANCING: A lease is a contractual agreement under which the

owner of the property (the lessee) gives the other party (the lessor) the right

to use the property. The lessee makes periodic payments to let the property outside

for some specified period, the term is called the lease rent.

PUBLIC

DEPOSIT: A company can raise money by

inviting the public to make a deposit. The deposit can take care of both longtime and

short-term financial needs of the business. The interest rate on deposits is

generally higher than what is offered by banks and other financial

institutions.

COMMERCIAL PAPER (CP): It is

an unsecured promissory note issued by a firm that usually ranges from 90 days to

364 days. Being unsecured, only those firms which have good credit ratings can

issue CP and its regulation comes under the Reserve Bank of India.

ISSUANCE OF EQUITY SHARES: Equity

Shares represent the owned capital of the company. Because of their fluctuating

earnings, equity shareholders are called Company's risk carriers. These shareholders

enjoy high returns from the company during the prosperity period.

They have voting rights in the management of the company

ISSUE OF

PREFERENCE SHARES: These confer a preferential

right to the share shareholders in respect of payment of income and repayment

of Capital. Investors who prefer stable income without taking on high risk prefer

these stocks. A company can issue different types of preference shares.

ISSUANCE OF DEBENTURES: Debentures represent the debt capital of a company

and the holders of the debentures are the creditors. These are fixed-charged funds

which has a fixed interest rate. Issuance of debentures is suitable when the

company's sales and earnings are relatively stable.

COMMERCIAL BANKS: Banks

provide short and medium-term loans to firms in every size. The loan is repaid

either in a lump sum or in installments. The interest charged by the bank depends

on factors including characteristics of the borrowing firm and the level of

interest rates in the economy.

FINANCIAL

INSTITUTIONS: Established by both

Central and State Governments. Many financial institutions across the country

to provide industrial finance to companies engaged in the business. This is also called the development Bank. This

source of financing is considered suitable when there are large funds it is

necessary for the expansion, restructuring, and modernization of the enterprise.

INTERNATIONAL

FINANCING: With the liberalization and globalization of the economy,

Indian companies have started raising funds from international markets.

International sources from which funding can be obtained include foreign

currency (FCNR) loans from commercial banks. Financial assistance provided by

international agencies and development banks, and issuance of financial instruments

in International Capital Markets (GDR/ADR/FCCB).

FACTORS

INFLUENCING CHOICE: Effective

evaluation of various sources should be established by the business to achieve

its main objectives. Choose the source of business finance depends upon factors

like cost, financial soundness, risk profile, tax benefits and flexibility to

receive funds. Need these factors the analysis should be done simultaneously

while taking the decision for the choice of suitable Source.

In this blog, I explained

in detail all aspects of the source of business finance.

This is useful for the civil service aspirants and all

other higher secondary students also. If anything is missed in this may be a comment

in the comment box. I wish all my readers once again. My HAPPY CHRISTMAS to all

my valued readers…thank you

No comments:

Post a Comment